Primoza Insolvenzverfahren: A Deep Dive Into The Insolvency Process

So, you’ve probably stumbled upon the term "Primoza Insolvenzverfahren" and wondered what it’s all about, right? Well, buckle up because we’re diving deep into this topic. Primoza Insolvenzverfahren is a crucial legal process that affects businesses and individuals alike. It’s not just about bankruptcy; it’s about finding solutions, restructuring, and sometimes even rebuilding. If you’re here, chances are you either need to understand it better or are directly affected by it. Either way, you’re in the right place.

Let me break it down for you in a way that’s easy to digest but still packed with valuable insights. Primoza Insolvenzverfahren isn’t just a fancy legal term—it’s a lifeline for those who find themselves in financial trouble. Whether you’re a business owner struggling to keep your company afloat or an individual drowning in debt, this process could be your ticket to a fresh start. Stick around, and I’ll walk you through everything you need to know.

Now, before we dive into the nitty-gritty, let’s set the stage. Understanding the insolvency process isn’t just about knowing the legal jargon. It’s about grasping the implications, the steps involved, and the potential outcomes. By the end of this article, you’ll have a clear picture of what Primoza Insolvenzverfahren entails and how it can impact your life or business. So, are you ready to get started? Let’s go!

- Luna Ms The Rising Star In The Music Industry

- Splatter Room Deutschland The Ultimate Guide To Extreme Entertainment

What is Primoza Insolvenzverfahren?

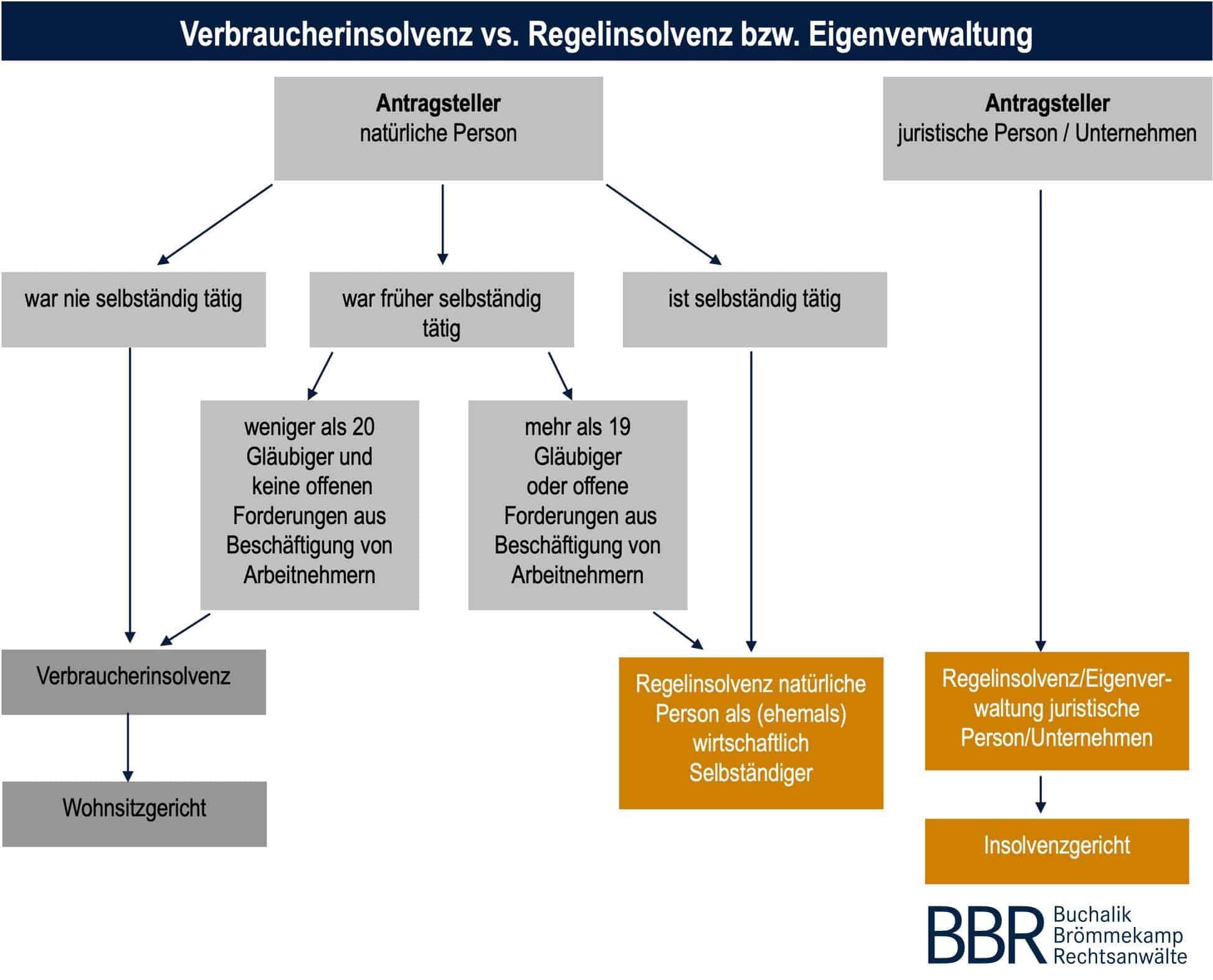

Alright, let’s start with the basics. Primoza Insolvenzverfahren is essentially the insolvency proceedings that take place under German law. When a company or individual can no longer meet their financial obligations, they can file for insolvency. This process aims to either restructure the debts or liquidate the assets to pay off creditors. It’s like hitting the reset button, but with a whole lot of legal paperwork involved.

Think of it this way: imagine you’re running a business, and suddenly, the cash flow dries up. You can’t pay your suppliers, employees, or even your own bills. What do you do? Primoza Insolvenzverfahren steps in to help you navigate this tricky situation. It’s not just about throwing in the towel; it’s about exploring all possible options to keep things moving forward.

Why Does Primoza Insolvenzverfahren Matter?

Here’s the deal: insolvency isn’t just a personal or business issue; it’s an economic one too. When companies or individuals go bankrupt, it affects the entire ecosystem. Creditors lose money, employees lose jobs, and the economy takes a hit. That’s why Primoza Insolvenzverfahren is so important—it provides a structured way to handle these situations and minimize the damage.

- K Idol Gmbh Your Ultimate Guide To The Rising Star In The Music Industry

- Fahrrad Nerz Tuttlingen The Ultimate Guide To Cycling Adventures In Germany

For businesses, it’s a chance to restructure and potentially save the company. For individuals, it’s an opportunity to clear overwhelming debts and start fresh. But here’s the kicker: it’s not a one-size-fits-all solution. Every case is unique, and the outcome depends on a variety of factors. That’s why understanding the process is crucial.

Key Players in the Insolvency Process

Who’s Involved in Primoza Insolvenzverfahren?

Now, let’s talk about the key players. First up, we have the debtor—that’s the person or company filing for insolvency. Then there’s the creditor, who’s owed money. And finally, there’s the insolvency administrator, who oversees the entire process. Think of the administrator as the referee, ensuring everything runs smoothly and fairly.

Each of these players has a specific role to play. The debtor needs to provide all the necessary financial information, the creditors need to submit their claims, and the administrator is responsible for evaluating everything and making recommendations to the court. It’s a team effort, but one where everyone has their own agenda.

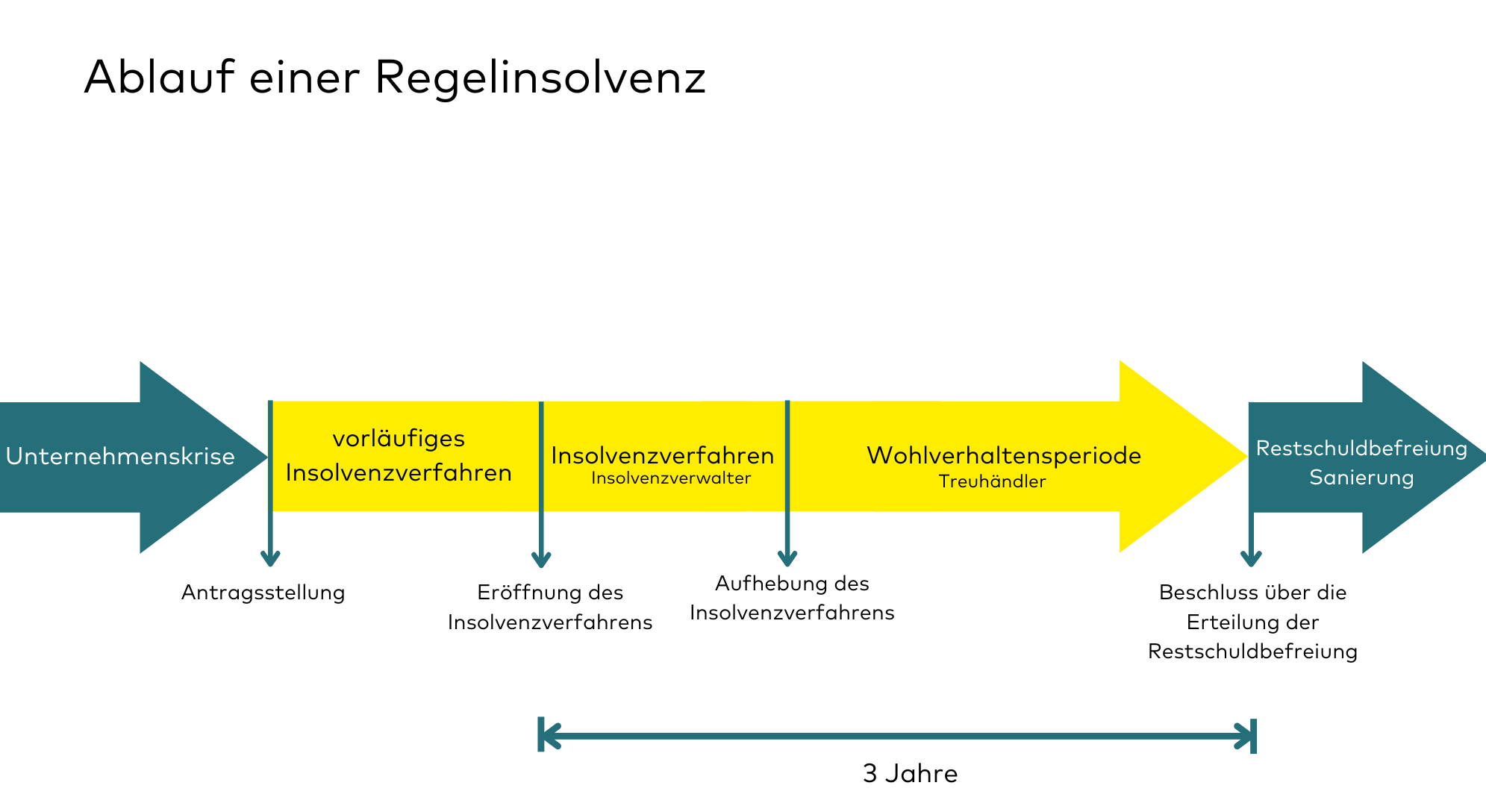

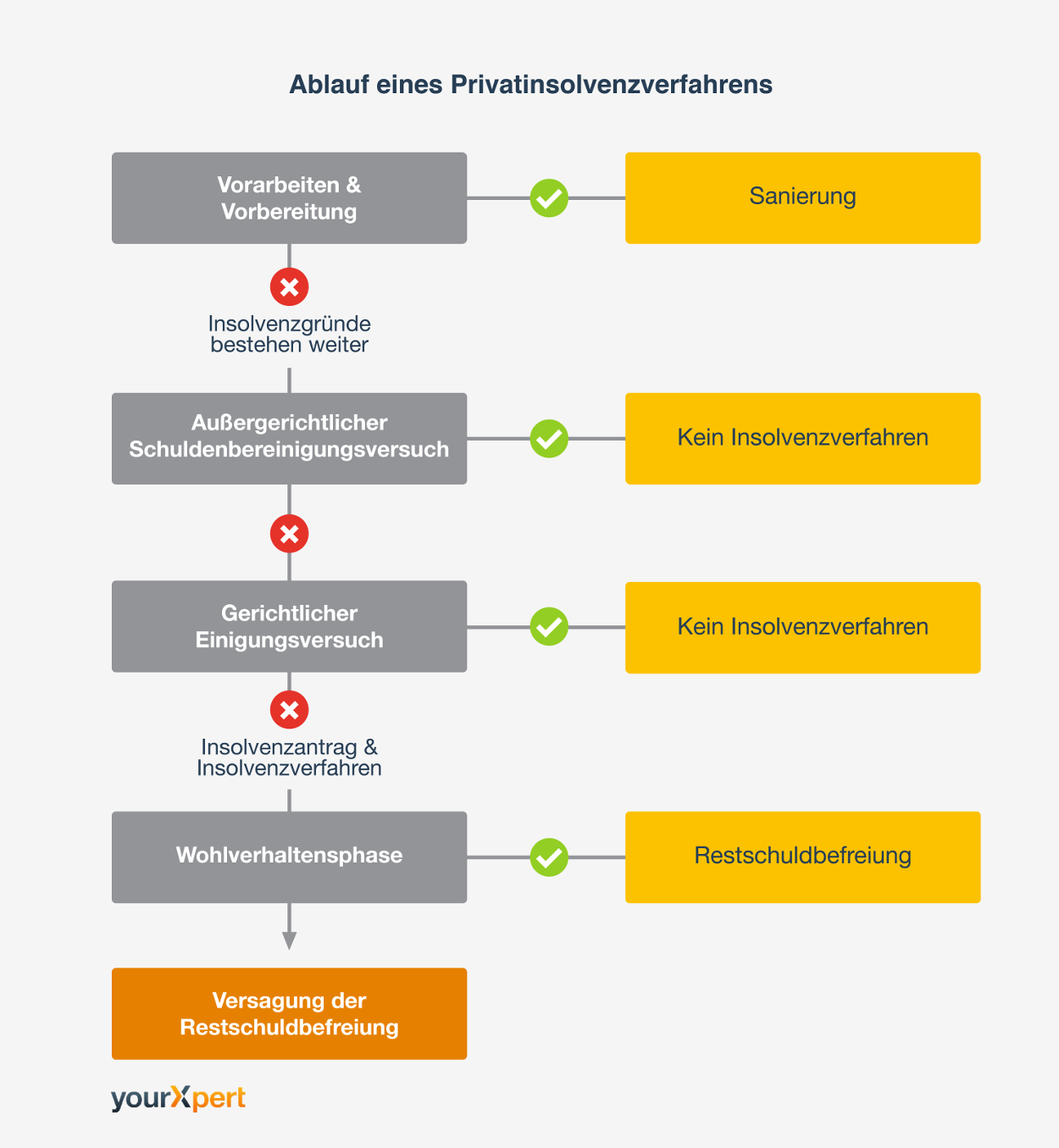

The Steps Involved in Primoza Insolvenzverfahren

How Does the Process Work?

Alright, let’s break it down step by step. First, the debtor files an application for insolvency with the court. This application must include detailed financial information, such as assets, liabilities, and cash flow statements. Once the court reviews the application, they’ll decide whether to open insolvency proceedings.

If the proceedings are opened, the insolvency administrator takes over. They’ll assess the debtor’s financial situation, review creditor claims, and decide on the best course of action. This could involve restructuring the debts, selling off assets, or even liquidating the business. It’s a complex process, but one that’s designed to achieve the best possible outcome for everyone involved.

Common Misconceptions About Primoza Insolvenzverfahren

There are a lot of myths and misconceptions floating around about insolvency. Some people think it’s the end of the road, while others believe it’s an easy way out. The truth is, it’s neither. Primoza Insolvenzverfahren is a serious legal process that requires careful consideration and planning. It’s not something to be taken lightly.

Another common misconception is that insolvency always leads to liquidation. That’s not true. In many cases, the goal is to restructure the debts and keep the business or individual afloat. It’s all about finding the best solution for the situation at hand.

Benefits and Drawbacks of Primoza Insolvenzverfahren

What Are the Pros and Cons?

Like any legal process, Primoza Insolvenzverfahren has its pros and cons. On the plus side, it provides a structured way to deal with overwhelming debts. It gives businesses a chance to restructure and individuals a chance to start fresh. It also ensures that creditors are treated fairly and have a chance to recover at least some of their money.

On the downside, it can be a lengthy and costly process. It requires a lot of paperwork, and there are no guarantees of a positive outcome. Plus, there’s the stigma associated with insolvency, which can have long-lasting effects on both businesses and individuals.

Practical Tips for Navigating Primoza Insolvenzverfahren

How Can You Prepare?

If you’re considering filing for insolvency, there are a few things you can do to prepare. First, gather all your financial documents. This includes bank statements, invoices, and any other relevant paperwork. The more organized you are, the smoother the process will be.

Next, consult with a legal expert. They can help you understand the process and ensure you’re meeting all the necessary requirements. And finally, be honest and transparent. The court and the insolvency administrator need accurate information to make informed decisions.

Real-Life Examples of Primoza Insolvenzverfahren

Let’s take a look at a couple of real-life examples to see how Primoza Insolvenzverfahren plays out in practice. Case A involves a small business owner who was struggling to keep up with mounting debts. After filing for insolvency, they were able to restructure their debts and keep their business running.

Case B, on the other hand, involved a larger company that was unable to recover. Despite the best efforts of the insolvency administrator, the company had to be liquidated, and the assets sold off to pay creditors. These examples illustrate the different possible outcomes of the insolvency process.

Statistical Insights into Primoza Insolvenzverfahren

According to recent statistics, insolvency cases in Germany have been on the rise. In 2022 alone, there were over 20,000 insolvency proceedings opened. This highlights the growing need for effective insolvency solutions. And while the numbers might seem daunting, it’s important to remember that each case is unique and requires a tailored approach.

Data from the German Federal Statistical Office shows that the majority of insolvency cases involve small and medium-sized enterprises. This underscores the importance of having robust insolvency laws and procedures in place to support these vital parts of the economy.

Conclusion: What You Need to Know About Primoza Insolvenzverfahren

So, there you have it—a comprehensive look at Primoza Insolvenzverfahren. Whether you’re a business owner or an individual facing financial difficulties, understanding this process can make all the difference. It’s not just about bankruptcy; it’s about finding solutions and rebuilding.

Remember, insolvency isn’t the end of the road. With the right approach and support, it can be the beginning of a new chapter. If you’ve found this article helpful, don’t forget to share it with others who might benefit from it. And if you have any questions or comments, feel free to drop them below. Let’s keep the conversation going!

Table of Contents

- What is Primoza Insolvenzverfahren?

- Why Does Primoza Insolvenzverfahren Matter?

- Key Players in the Insolvency Process

- The Steps Involved in Primoza Insolvenzverfahren

- Common Misconceptions About Primoza Insolvenzverfahren

- Benefits and Drawbacks of Primoza Insolvenzverfahren

- Practical Tips for Navigating Primoza Insolvenzverfahren

- Real-Life Examples of Primoza Insolvenzverfahren

- Statistical Insights into Primoza Insolvenzverfahren

- Conclusion

Detail Author:

- Name : Ms. Annamarie Schuppe Sr.

- Username : chauncey56

- Email : justyn.rodriguez@gmail.com

- Birthdate : 1996-03-08

- Address : 547 Schuster Rapid Apt. 335 Lake Mathew, HI 09681-4111

- Phone : 831.796.8227

- Company : Volkman-Gibson

- Job : Poet OR Lyricist

- Bio : At in magnam et non repellendus exercitationem. Rem omnis illo repellendus repellendus iste ipsam est. Unde maiores suscipit modi porro qui ut ducimus. Reiciendis ut facilis reiciendis optio.

Socials

tiktok:

- url : https://tiktok.com/@jspencer

- username : jspencer

- bio : Rerum suscipit impedit dolorem. Quaerat qui omnis esse quia.

- followers : 1604

- following : 2278

instagram:

- url : https://instagram.com/jaquelin2777

- username : jaquelin2777

- bio : Deleniti culpa omnis eum dolorum odio aut. Ab explicabo sunt iusto autem.

- followers : 1033

- following : 2857